BY RACHID BUGIRIMFURA

KIGALI – A Rwandan cryptocurrency agent is in jail facing fraud charges and another is being investigated in one of the country’s largest fraudulent cryptocurrency schemes in recent years.

The Rwanda Investigation Bureau began probing investments by Legacy Plus, a company linked to cryptocurrency scheme, BitSec, in late 2023 following complaints from dozens of victims, who allege they were scammed out of hundreds of thousands of dollars.

The High Court of Rwanda froze Legacy Plus Ltd assets in January 2024, as well as the private properties belonging to Bagire Eugene, a BitSec promoter and primary agent for Legacy Plus, who is currently in custody, and Legacy Plus chief executive, Aimable Nkuranga, who is under investigation but has not been detained, according to court documents seen by Integonews.

Interest in cryptocurrencies has soared in price and popularity over the past few years as investors chase big returns. However, cryptocurrencies are banned in Rwanda and a draft law to regulate virtual assets was introduced in March 2024 by the Rwanda Capital Markets Authority (CMA) and the country’s central bank, citing concerns over money laundering.

Promises of good return

BitSec operated as a digital token system where investors purchased tokens at a set price with promises that the value would increase substantially over time. The company claimed these tokens were backed by real-world assets and innovative blockchain technology, according to marketing materials reviewed by Integonews.

Elly Nsengimana, a 34-year-old Rwandan businessman, said he lost more than six million Rwandan francs (US $6,000) after buying into the scheme in August 2023.

“I personally invested over six thousand dollars, but I have friends and relatives who were also convinced to invest well over ten thousand dollars each,” he said in an interview. “We transferred the money through someone named ‘Baze’ or wired it to an account that we were instructed by him to use. I was physically in Kenya at the time.”

Nsengimana is one of at least 50 investors who have come forward to authorities, claiming they were defrauded by Legacy Plus agents Bagire Eugene and Kalibutwa Lambert, who promised big returns for Bitsec investments that never materialized, according to Rwanda Investigation Bureau reports reviewed by Integonews.

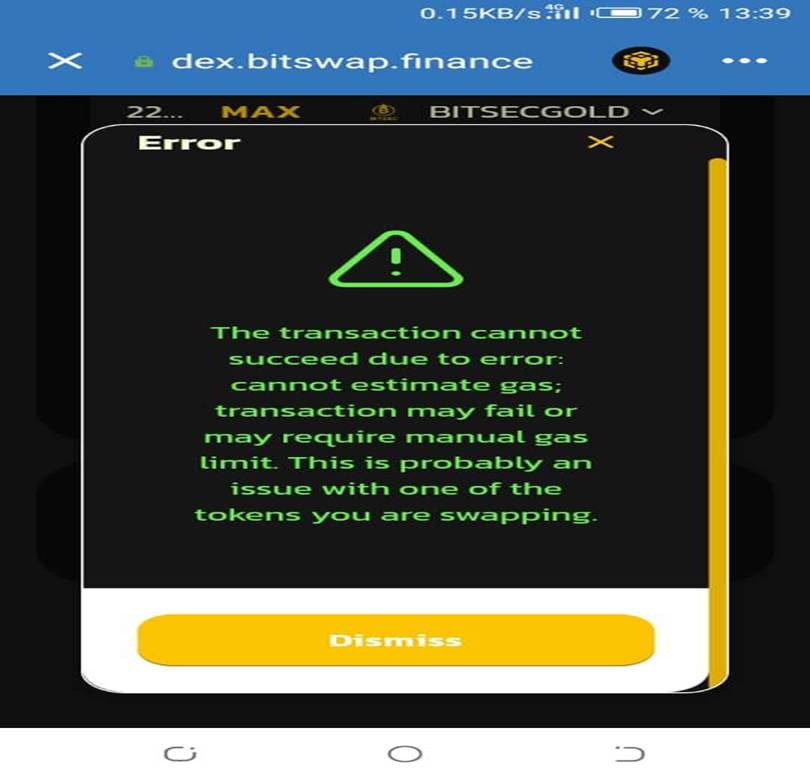

BitSec transactions have been rendered dysfunctional, and investors can no longer claim their money.

Bagire Eugene and Kalibutwa Lambert deny any wrongdoing.

In a statement to Integonews, provided through their lawyer, Jean de Dieu Nduwayo, both denied personally taking any money and said efforts were being made to address investors’ concerns.

“My clients were merely acting as agents for Legacy Plus and followed all protocols established by the company,” Nduwayo said when contacted by phone. “They believe this is a misunderstanding that will be resolved once all facts are presented in court.”

Jean Bosco Mutungirehe, a 42-year-old civil engineer, said his Bitsec investment paid out at first before he lost the money. “I had invested two thousand dollars and gained a profit of $1,630 at first,” he said in an interview. “Later, they didn’t pay me any further returns, which is how I lost my money.”

Investors have no formal agreements or written contracts with Bitsec, which has made it difficult to claim for losses, they said. Mutungirehe said he made most payments directly to an agent in cash or through mobile money transfers.

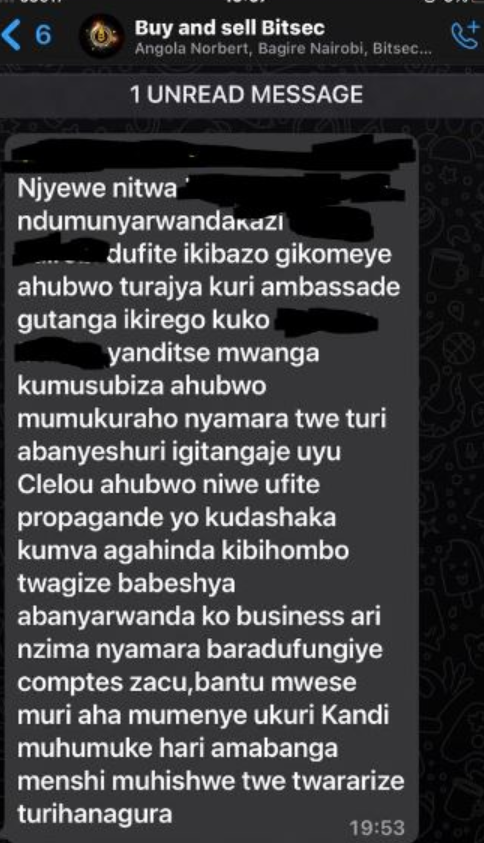

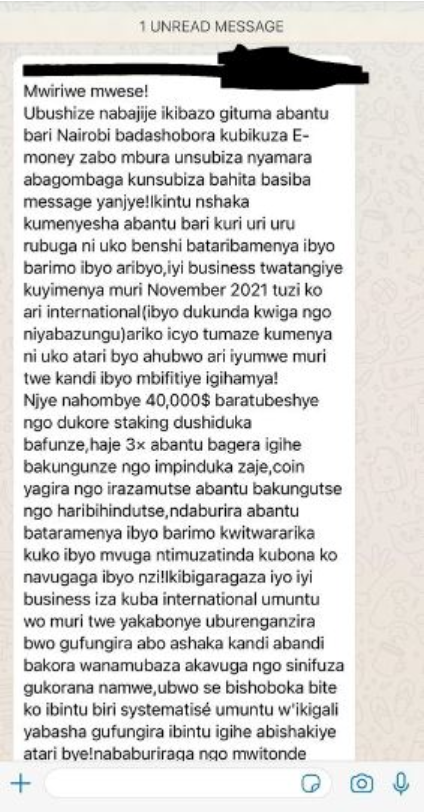

Alleged Bitsec investors share their experiences on a WhatsApp group. “We are going to file complaints at the Rwandan Embassy in Nairobi because we were duped,” wrote one investor. “Some individuals gave us the impression that this was a legitimate enterprise, but now our accounts are blocked,” the man wrote.

investor explained..

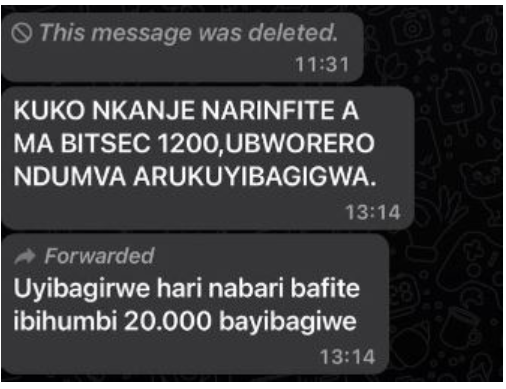

WhatsApp group conversation between the victims and Legacy Plus staff, where victims are told to forget about their investments

Another investor claimed he lost 1,200 BitSec tokens, while a forwarded message in the group mentioned another investor who allegedly lost 20,000 tokens.

Rise of Bitsec and Legacy plus

BitSec was launched in 2021 by Legacy Plus Ltd, a company founded by Aimable Nkuranga, the former executive director of Rwanda’s Association of Microfinance Institutions (AMIR). Leveraging his financial industry contacts, Nkuranga quickly established credibility for his firm.

Through public addresses and events, he courted officials from government financial institutions to lend legitimacy to his business. Legacy Plus used social media platforms, particularly YouTube, to market their product to potential clients, according to company marketing materials and social media posts reviewed by Integonews.

According to three investors who attended the presentations and spoke to Integonews on condition of anonymity, the company organized national and international conferences promoting BitSec technology and cryptocurrency investments in Kigaliand Rubavu between 2021 and 2023.

Regulatory Gaps

The Financial Intelligence Centre of Rwanda acknowledged in a December 2024 report the absence of proper regulations to curb crypto activities in the country. The issue has been taken up by the Central Bank of Rwanda (BNR), the country’s monetary policy regulator.

In a speech to Parliament on January 21, 2025, Minister of Justice Ugirashebuja Emmanuel said Rwanda’s government planned to revise its anti-corruption policy, including to address the role of cryptocurrencies, which he said can enable corruption.

“The 2012 policy enabled us to achieve significant milestones, such as enacting various laws and introducing systems that promote accountability. However, new forms of corruption emerge as the world evolves, necessitating a revised policy,” he said.

The minister highlighted the emergence of cryptocurrencies as an area not covered in the 2012 policy.

“Cryptocurrency payments were nearly unknown when the policy was established,” he said, adding: “Now they present new challenges in tackling corruption.”

Gerald Nsabimana, BNR market conduct director, highlighted the risks of unregulated crypto investments. “Most companies that intend to defraud individuals take advantage of cryptocurrency technology,” he told Integonews in an interview. “Yet, the central bank has made it very clear that anyone who invests in cryptocurrency companies is responsible for whatever losses they may incur, because in Rwanda, there are no regulatory laws regarding cryptocurrencies,” Nsabimana added.

The central bank cited other crypto scams such as Billion Traders FX, which allegedly defrauded investors of over 10 billion Rwandan francs (US $10 million). The owners of Billion Traders FX, businessman, Davis Sezisoni Manzi, and his wife Sophie Akaliza, were arrested in 2023 and are currently awaiting trial on charges of money laundering, fraud, and illegal foreign exchange trading.

Nsabimana said other suspicious firms have appeared in Rwanda, including Pi Network, a cryptocurrency platform; DYNANCE, a company claiming to trade in medical products but operates as a pyramid scheme; and FlexFund, which presents itself as an investment platform offering cryptocurrency trading services with guaranteed returns.

Cross border implications

Habyarimana Straton, a financial expert at the University of Rwanda, explained that crypto scams, like BitSec, exploited regulatory loopholes to easily move money across borders.

“In the absence of clear regulation, cryptocurrencies can be used for money laundering, making it difficult for officials to trace the final destination of investors’ funds,” Straton said in an interview.

Beyond Rwanda

Emmanuel Kubwimana, who helped promote BitSec in neighbouring DRC, said he was threatened by angry investors.

“I was in Goma promoting BitSec to locals, but now I’m being threatened by Congolese investors who are demanding their money back,” said Kubwimana, when reached by telephone.

Three sources with personal knowledge of the complaints told Integonews that several Rwandan citizens have filed fraud complaints with the Rwandan Embassy in Nairobi, Kenya, claiming they were defrauded by Legacy Plus or its agents.

Their claims could not be independently verified by Integonews.

Denials of Involvement

Legacy Plus CEO Aimable Nkuranga denied the involvement of the company in disputes.

“Legacy Plus Ltd is an investment opportunity-based consulting firm,” Nkuranga said in a written statement to Integonews. “If someone was invited to invest, it was done by third parties acting independently,” he wrote.

Nkuranga, however, acknowledged that Legacy Plus organized conferences promoting BitSec technology. “We organized educational seminars about savings, blockchain technology and digital assets, but we never directly solicited investments or handled any client funds,” he said in his written response to questions.

Attempts by Integonews to reach prosecutors handling the Bitsec case were unsuccessful. Faustin Nkusi, a spokesman for the prosecution, declined to comment on what he said was an ongoing investigation.

With legal proceedings underway, victims said they still hope to recover their money. However, with no clear laws governing crypto regulation, it is unlikely they will recoup their losses, according to financial expert Straton.

Straton, the financial expert, said investors should beware of crypto-linked schemes. “Always verify the legitimacy of investment opportunities with established financial institutions and check if they are registered with regulatory authorities,” he said.

The project received support from the Thomson Reuters Foundation as part of its global work aimed at strengthening free, fair and informed societies. Any financial assistance or support provided to the journalist has no editorial influence. The content of this article belongs solely to the author and is not endorsed by or associated with the Thomson Reuters Foundation, Thomson Reuters, Reuters, nor any other affiliates.